san francisco sales tax rate breakdown

The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a. Businesses impacted by recent California fires may qualify for extensions tax relief and more.

State And Local Sales Tax Rates 2018 Tax Foundation

The statewide tax rate is 725.

. There is no applicable city tax. San Francisco County CA Sales Tax Rate San Francisco County CA Sales Tax Rate The current total local sales tax rate in San Francisco County CA is 8625. With local taxes the total sales tax rate is between 7250 and 10750.

This includes the rates on the state county city and special levels. The transient occupancy tax is also known as the hotel tax. South San Francisco is located within.

The minimum sales tax in California is 725. 864 Average Sales Tax Summary The average cumulative sales tax rate in San Francisco California is 864. Those district tax rates range from 010 to.

This is the total of state and county sales tax rates. This includes the rates on the state county city and special levels. Please visit our State of Emergency Tax Relief page for additional information.

The average cumulative sales tax rate in South San Francisco California is 988. The current total local sales tax rate in san francisco ca is 8625. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

The December 2020 total local sales tax rate was 8500. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. San francisco sales tax rate breakdown.

The San Francisco County sales tax rate is. San Francisco imposes a 14 transient occupancy tax on the rental of accommodations for stays of less than 30 days. Since 1974 the San Francisco sales tax rate has increased eight times from 650 percent to the current rate of.

The 2018 United States Supreme Court. The San Francisco County sales tax rate is. The California state sales tax rate is currently.

San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco CA is 8625. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar. Limited to 15 per year on the minimum base tax 30 per year on.

New Sales And Use Tax Rates Take Effect In Some East Bay Cities This Week San Ramon Ca Patch

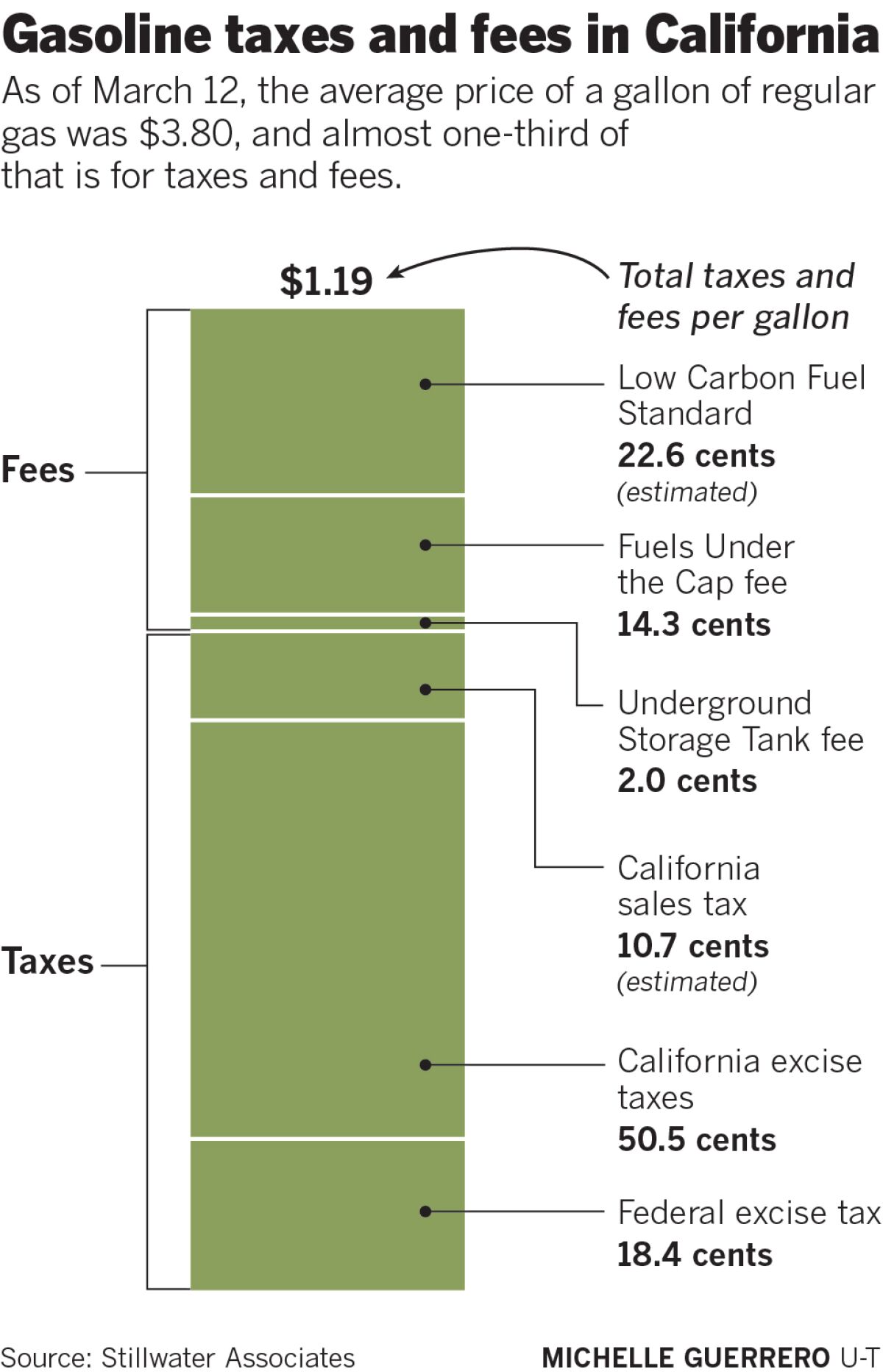

Gas Tax Rates By State 2021 State Gas Taxes Tax Foundation

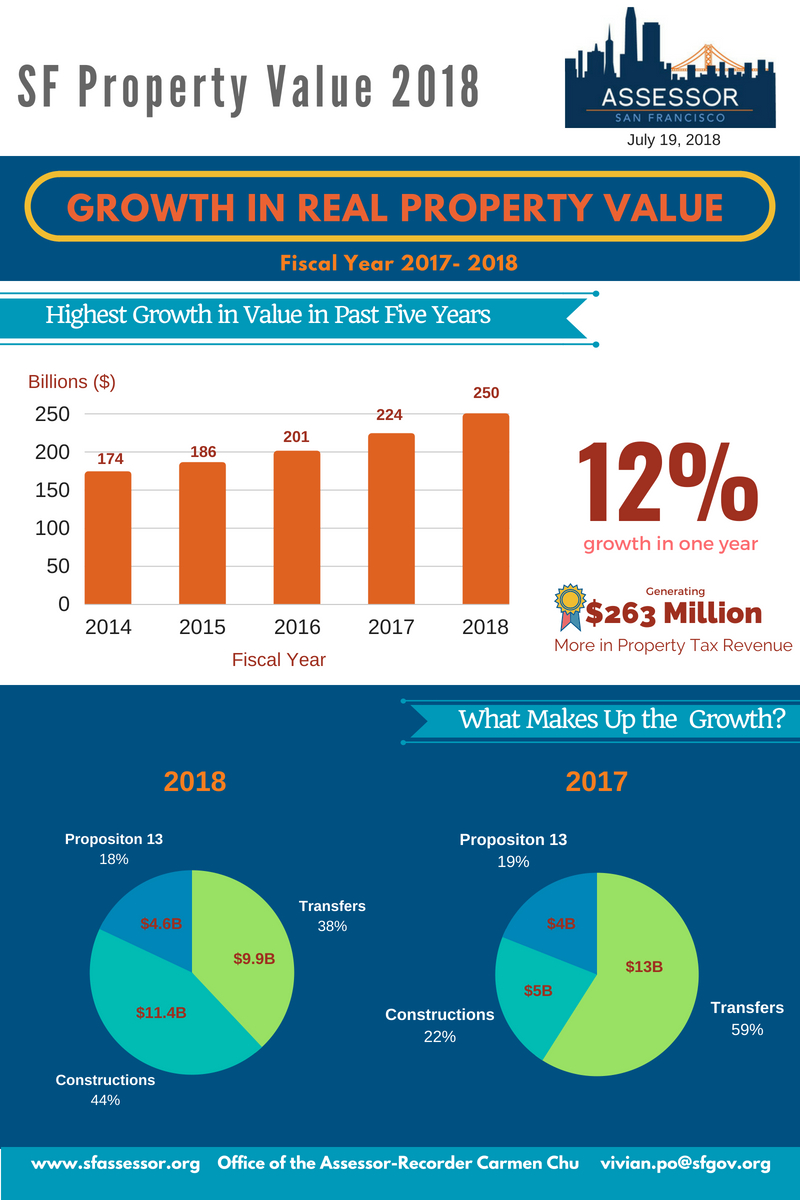

San Francisco Leads Ca Counties On Property Tax Growth Ccsf Office Of Assessor Recorder

Understanding California S Sales Tax

New Sales And Use Tax Rates In Fremont East Bay Effective April 1 Fremont Ca Patch

Solving Sales Tax Applications Prealgebra Course Hero

California Taxes A Guide To The California State Tax Rates

Funding Seamless Transit Part 2 Who Pays What For Transit In The Bay Area Seamless Bay Area

In California Transfer Taxes Are Hefty What Sellers Need To Know

How Much Are You Paying In Taxes And Fees For Gasoline In California The San Diego Union Tribune

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

How Do State And Local Sales Taxes Work Tax Policy Center

What Is A Progressive Tax 2020 Robinhood

Understanding California S Sales Tax

California Income Tax Calculator Smartasset

The Most And Least Tax Friendly Major Cities In America

How To Calculate California Sales Tax 11 Steps With Pictures